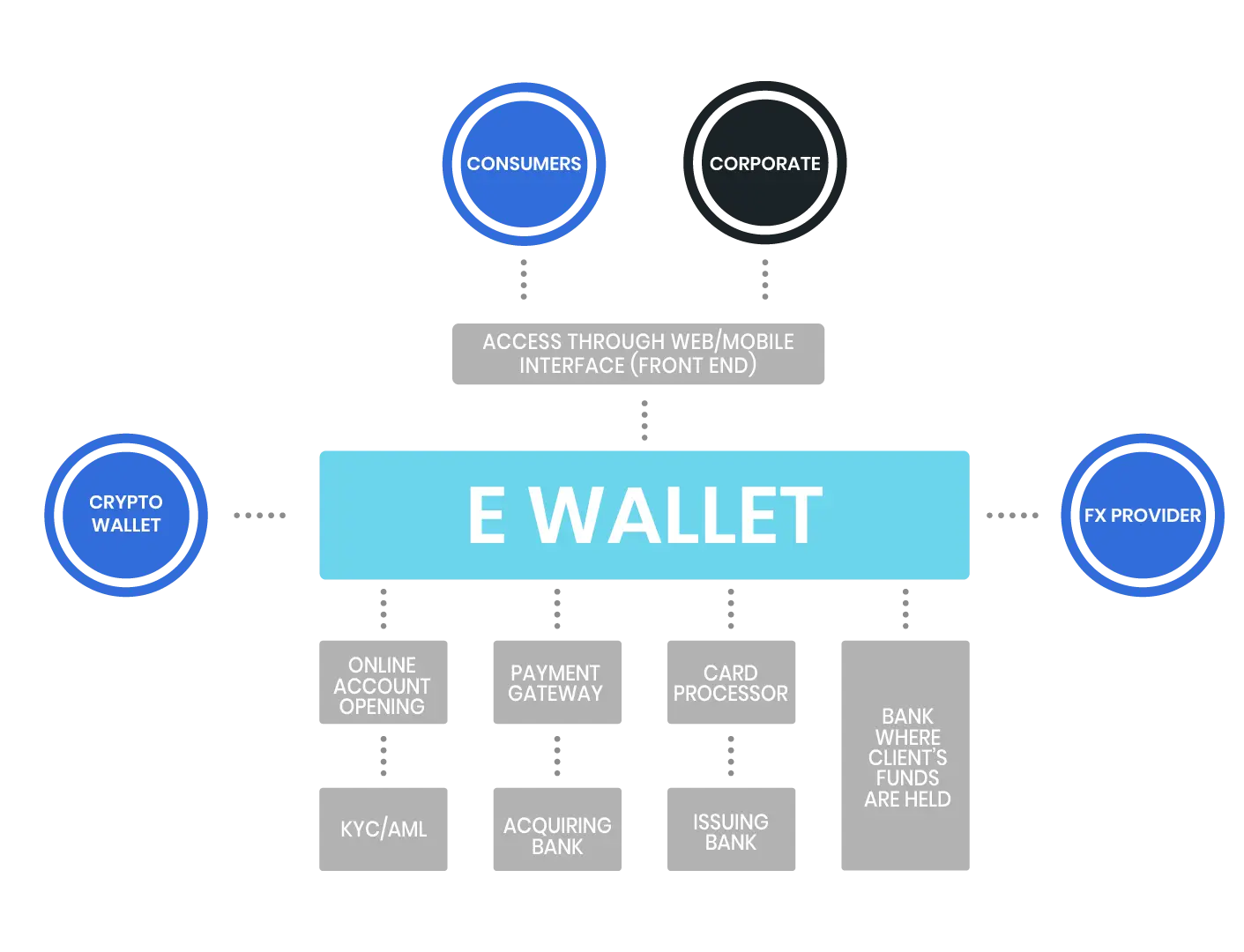

E-wallet

Fintech Solutions at Your Fingertips

Core solution for transaction and transfer

Our e-wallet solution is available to financial institutions or start-ups through two possible models of cooperation:

Source code

For those clients who have development teams ready to work on source code, preform own updates and upgrades of the software.

Software as a service

Client is given license for the software. Software can be installed on any server of clients’ choice or be part of our cloud services. This model includes regular support and maintenance.

Functionalities

Online Customer Onboarding

- ► E-wallet platform enables online account opening for both individual & business users.

- ► Customers can easily open account by submitting their basic details, IDs and selfie, while operators in the back-office can see all the details about customers and their documents and handle all customer related information.

- ► System also support manual approval of customers.

Account Top-up & Bank Transfers

- ► Platform supports multi-currency accounts with possibility to add any currency you want.

- ► Accounts can be topped up with existing cards, bank transfers or cash, and further integrations can be made.

- ► Customers can also do SEPA, SWIFT and internal transfers.

- ► Operators in the back-office can access information on accounts and transactions in real time.

Currency Conversions

- ► Customers can get access to real-time exchange rates, with all major currencies being supported.

- ► There is a possibility to make exchanges in over 30 different currencies.

- ► System can show inverse rates for currency pairs.

- ► Conversions are made instantly and operators in the back office have all information about the conversion made.

Card Issuing

- ► Customers can be issued with debit and/or prepaid card.

- ► Card issuance is instant with option for customers to order physical or virtual cards.

- ► Customers can manage their cards – activate, change PIN, report lost/stolen.

- ► Top-up of prepaid cards can be done from account.

- ► Operators in the back office can manage all the cards as well as the users.

Card Management

- ► Operators in the back office can change fees and limits in real time.

- ► Fees and limits can be different for different types of users.

- ► There is an option to set limits for any type of transactions – account maintenance, bank transfers, FX, top-up, POS, ATM, card issuance.

- ► Fees can also be set for any type of an transactions – they can be defined as fixed amount, percentage, or combination of both.

Transactions & Reporting

- ► Operators in the back office can search through transactions using various parameters based on time period or customer.

- ► Transactions can be searched by currency or transactions status.

- ► All transactions are available in real-time and provide full details.

- ► Reports can be generated for any given period containing all details about transactions.

Internal Communication System

- ► Operators in the system can communicate through internal ticketing system.

- ► Operators can submit issues related to bugs, users or other problems and set risk level (high, medium, low). Issues can also be resolved by certain operators in the system

- ► Issues can be filtered by category or by type of issue.

Want to learn more ?

If you are looking for a new solutions for your business or you want to enhance your current IT technology and processes our team can help in each step of this process – from planning to implementation all with goal of making your business ready to step into new digitalized market.